If you’re a student or parent of one, you’ve probably heard a lot about federal student loans. But what are they? And who needs them? We’ll dig into the details and explain how to get your hands on these helpful funds.

Higher education is a significant investment, and for many, federal student loans are a necessary part of funding their future. However, understanding the repayment process and managing your loans effectively is crucial to avoid falling into debt. If you find yourself struggling to keep up with payments, reaching out to a collection agency can provide you with the necessary tools and advice to navigate your financial situation. Remember, there’s always help available; you just need to know where to look.

What are federal student loans?

Federal student loans are made by the federal government. These loans are available to students who qualify for financial aid, which means they have demonstrated a need for assistance with paying tuition and other expenses related to their post secondary education.

Federal student loans are repaid by the borrower rather than being repaid by someone else on the borrower’s behalf, such as a parent or guardian.

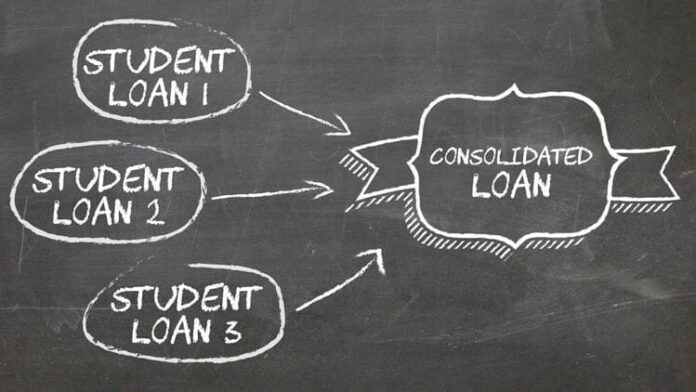

What are consolidated federal student loans?

Consolidated federal student loans are a type of loan provided by the United States Department of Education that allows borrowers to consolidate multiple federal student loans into a single loan.

This can help borrowers manage their loan payments more easily and may also qualify them for different repayment plans or loan forgiveness programmes. Borrowers must apply for a Direct Consolidation Loan through the Department of Education’s website to consolidate federal student loans.

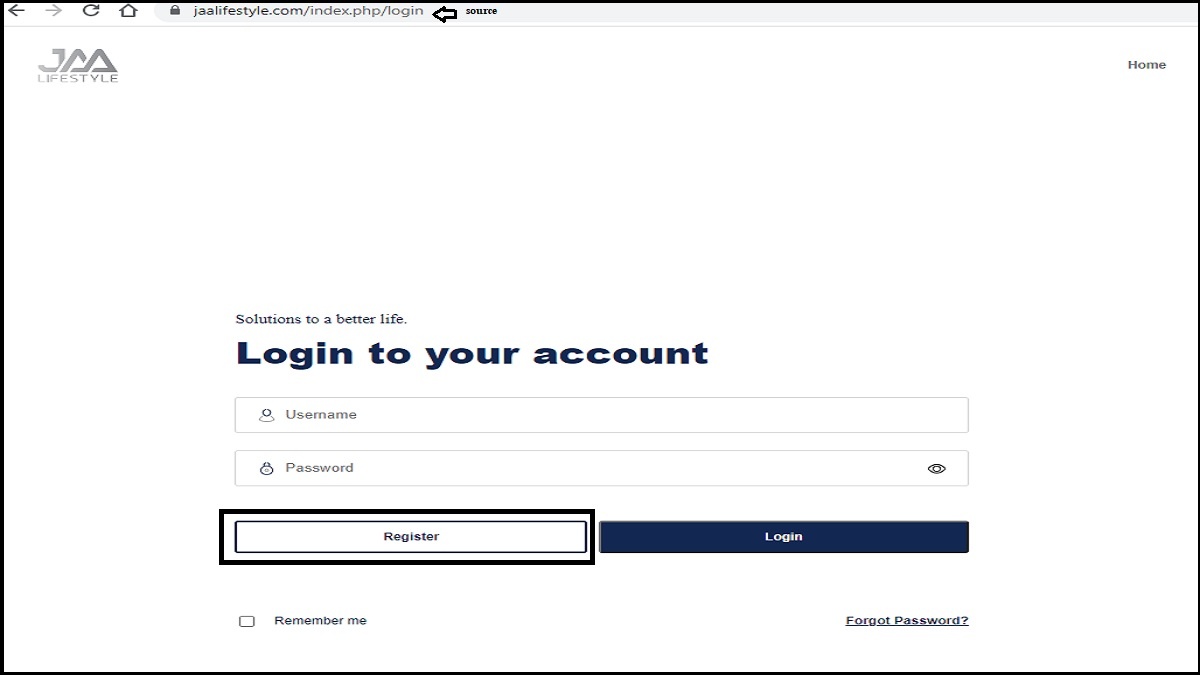

How do you get federal student loans?

- Apply through the government website.

- Fill out the FAFSA form. The FAFSA (Free Application for Federal Student Aid) is a federal form that you can fill out online, and it’s required to get any federal student loan. You’ll also need to submit it annually if you’re still enrolled in school; this lets the government know how much money they should give you each year. As long as you’re a US citizen or permanent resident with a valid Social Security number (SSN), have been accepted at an accredited school and are enrolled in a degree program there, then yes! You will be able to get some help paying for college costs with federal student loans.

Who can get federal student loans?

Federal student loans are available to you if you’re a U.S. citizen, national or permanent resident who meets the following criteria:

- You’re enrolled in an eligible program at an eligible school

- You are enrolled at least half time

- You have a good academic standing (as determined by your school)

How much can you borrow?

When it comes to federal loans, the first thing you need to know is how much you can borrow. That’s because the amount you can borrow depends on a variety of factors, including your year in school and whether or not you are a dependent or independent student (i.e., someone who lives with their parents).

If you’re attending college as an undergraduate, for example, the maximum amount that federal student loans will cover differs depending on whether or not you are considered an independent student. As an independent student (meaning one who does not live at home), undergraduates may borrow up to $5,500 per year during their freshman and sophomore years; this increases by $1,000 each year thereafter until reaching $12,500 during junior and senior years.

Undergraduate students who do live at home with their parents must also consider whether they qualify as dependent students and therefore have more limitations placed on them when it comes to how much money they can get from the government each year before determining how much they should take out through federal loans.

With so much information available, it can be hard to know where to start. But if you want to go to college, you can get all the information on federal student loans online in one place so you can easily find what you need. With numerous options available online, SoFi, an online loan provider, stands out as a better way to pay for college. From understanding how they work and getting approved for them, through repayment options and managing debt after graduation – they have got everything covered.